Biweekly Mortgage PaymentsĪ single monthly payment for the life of the loan is the default repayment frequency for most borrowers. Any additional payments you make are more effective when they’re applied earlier in the repayment term when your monthly interest charges are higher. The best option depends on how much extra you’re willing to put toward the loan and how quickly you want to pay off your home loan.

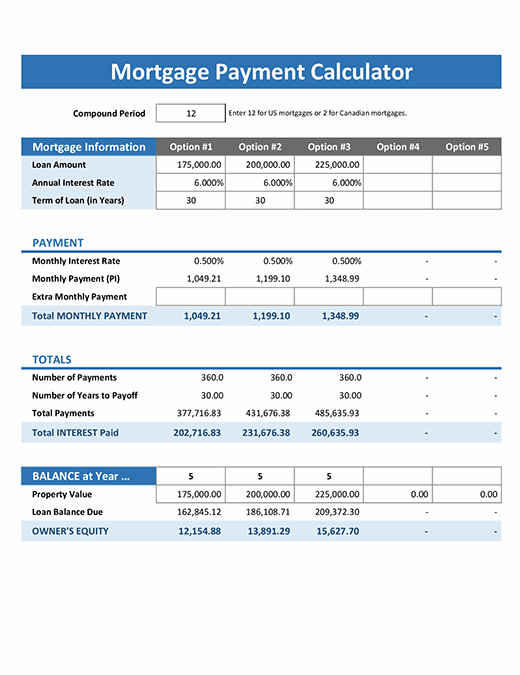

There are multiple repayment strategies for owning your home outright sooner. Be sure to check with your lender to verify there are no prepayment penalties. This is the amount you’ll apply to your loan principal. Decide how much your extra payment amount will be. You can increase your extra payment amount or frequency as your finances improve. Decide between making monthly contributions or a single lump sum payment. This is different from your annual percentage rate (APR), which includes additional loan expenses, like mortgage insurance and discount points. List your current mortgage interest rate. The most common mortgage terms are 15 years and 30 years. Enter the number of years of your purchase loan. If you’re refinancing or already making repayments, include your minimum monthly mortgage payment, excluding taxes and insurance. Monthly interest and principal payments.If you’re refinancing or already making repayments, list the outstanding mortgage principal that needs to be repaid. This calculator won’t factor in private mortgage insurance or similar premiums. With a purchase loan, input your down payment amount as a percentage. If you have a purchase loan, input the price you paid for the home. Choose “refinance” if you’re getting a mortgage refinance or keeping your current loan. Choose “purchase” if you plan on buying a home and making extra payments immediately.

#ONE LUNP SUM FIXED PAYMENT MORTGAGE CALCULATOR HOW TO#

The other thing you need to make clear to your lender is that you want your overpayments to have the effect of reducing your mortgage term rather than reducing your monthly payment.How To Use the Additional Payment Calculatorīelow is a detailed summary of how to enter the appropriate loan information for a new or existing mortgage: At Santander the limit applies to a calendar year, so it is reset on 1 January. At HSBC, the year’s limit is reset annually, either on the date your mortgage account was opened or the date you switched to a fixed rate.

So the amount you can overpay remains the same for the whole of the mortgage term.Īt HSBC, Santander and Yorkshire building society, however, the 10% limit is applied to the outstanding balance each year, so the amount you can overpay goes down. At Nationwide building society, for example, the limit is 10% a year of the original loan amount (for all mortgage products reserved on or after, except for standard mortgage rate and base rate mortgages where no limits apply). You also need to look closely at the detail to avoid going over your lender’s limit. With fixed-rate mortgages this is typically 10% of the mortgage loan, although a handful of lenders let you overpay up to 20%. This is the amount you can overpay each year without incurring any early repayment charges. So before you set up overpayments on your mortgage, you need to ask your lender what your annual overpayment allowance is.

0 kommentar(er)

0 kommentar(er)